PLANT CONSTRUCTION SURVEY Part 1

47th ANNUAL

Plant Construction

survey

Construction in the food and beverage industry is continuing, but there’s a bit of “wait and see” happening due to the presidential election occurring later this year.

Part 1

A M King recently designed and built the ALDI Regional Headquarters & Distribution Center in Loxley, Ala. Image courtesy of A M King

Most everyone is probably familiar with the idea of a gap year, which is typically defined as a time where students take a break from studies, usually taken during a transition between different levels of learning—essentially a time between different stages of someone’s life. According to this year’s Annual Construction Survey, 2024 might be considered a gap year for construction in the food and beverage industry. The reason? Well, in case you hadn’t noticed, 2024 is an election year. Because of that, companies are taking a wait-and-see approach to bigger-scale projects in general until after the election.

“Since this is an election year, we are seeing food and beverage clients take longer to make decisions on scope and cost early in design due to economic uncertainty,” says Jamie Bailey, vice president of client strategy with McCownGordon. “Some projects have slowed, and others have been put on hold all together. It is a hurry up and wait scenario in most cases.”

Robb Rainey, project director of food & beverage manufacturing with Burns & McDonnell, agrees and adds, “There is a noticeable hesitancy to spend large capital on construction projects. While many projects are being planned and developed, they are not progressing to the construction phase as quickly as they have over the past five years. Supply chain constraints and rising interest rates are significant factors causing delays in construction projects. These challenges are creating uncertainties and increasing costs, making companies more cautious about committing to new projects.”

BY Derrick Teal

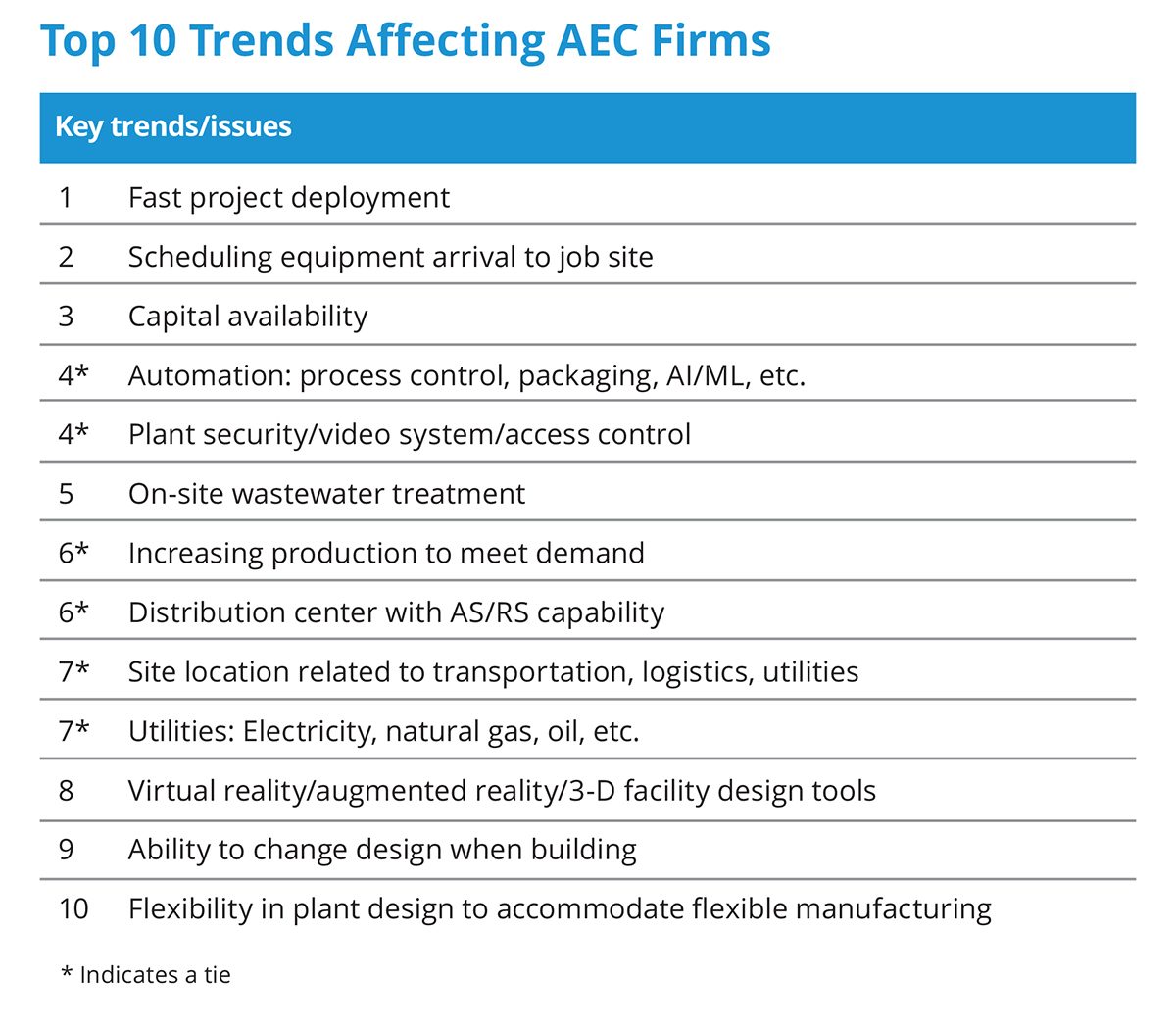

Shown are the top 10 trends affecting AEC firms with food and beverage construction.

Pandemic in the Rearview

While the hesitancy to commit to a larger project is due to uncertainty, almost none of that uncertainty has to do with the pandemic. Yes, there are still supply chain issues. Yes, interest rates are high. Yes, inflation is higher than normal. But all of those have plateaued even amid the upcoming changes in governance in the U.S.

“The sharp increase in lead times and material shortages associated with the onset of the COVID-19 pandemic has nearly subsided to pre-pandemic levels,” says Paul Kornman, a senior project manager with Gray who was on the project team for FOOD ENGINEERING’s 2023 Plant of the Year, Clemens Food Group’s Hatfield North facility, which was constructed during the pandemic. “While supply chain constraints, lack of laborers and cost escalation will continue to be areas of concern, they no longer induce panic among project teams and investors the way they have in recent years.

“Electrical gear, associated distribution equipment and other central utility equipment are still experiencing long lead times,” Kornman adds. “This has led Gray and others to emphasize early procurement with customers, as project schedules are at the mercy of the availability of this critical equipment. Despite the challenge of operating with an incomplete picture of the project, teams that can make decisions on sizing electrical components early in the project can dramatically impact the delivery dates. For retrofit projects, rapid discovery of existing utility capacities is vital. The quicker a contractor can be released to procure long lead items, the more successful a project will be.”

Food and beverage manufacturers are still investing in their facilities and operations, even if they’re typically not of the larger variety. “We are still seeing clients investing in their facilities to increase volume, primarily through upgrades to existing lines or new line installations,” says Bailey. “Others are investing in sustainability projects through upgrading utility technology and wastewater treatment. Also, many existing facilities are aging requiring clients to renovate or execute critical infrastructure projects.”

“Manufacturers investing in their facilities to increase volume is a trend we are observing in the industry,” says Raney. “Manufacturers are not only increasing capacity but also making significant investments in sustainability, automation and the replacement of aging assets. They are prioritizing the upgrade of existing infrastructure to enhance operational efficiency. While there has been a decrease in new greenfield projects, there is a notable increase in brownfield projects aimed at expanding capacity within existing facilities. Additionally, manufacturers are focusing more on sustainability initiatives and solutions to address workforce availability, reflecting a broader commitment to long-term operational resilience and environmental responsibility.”

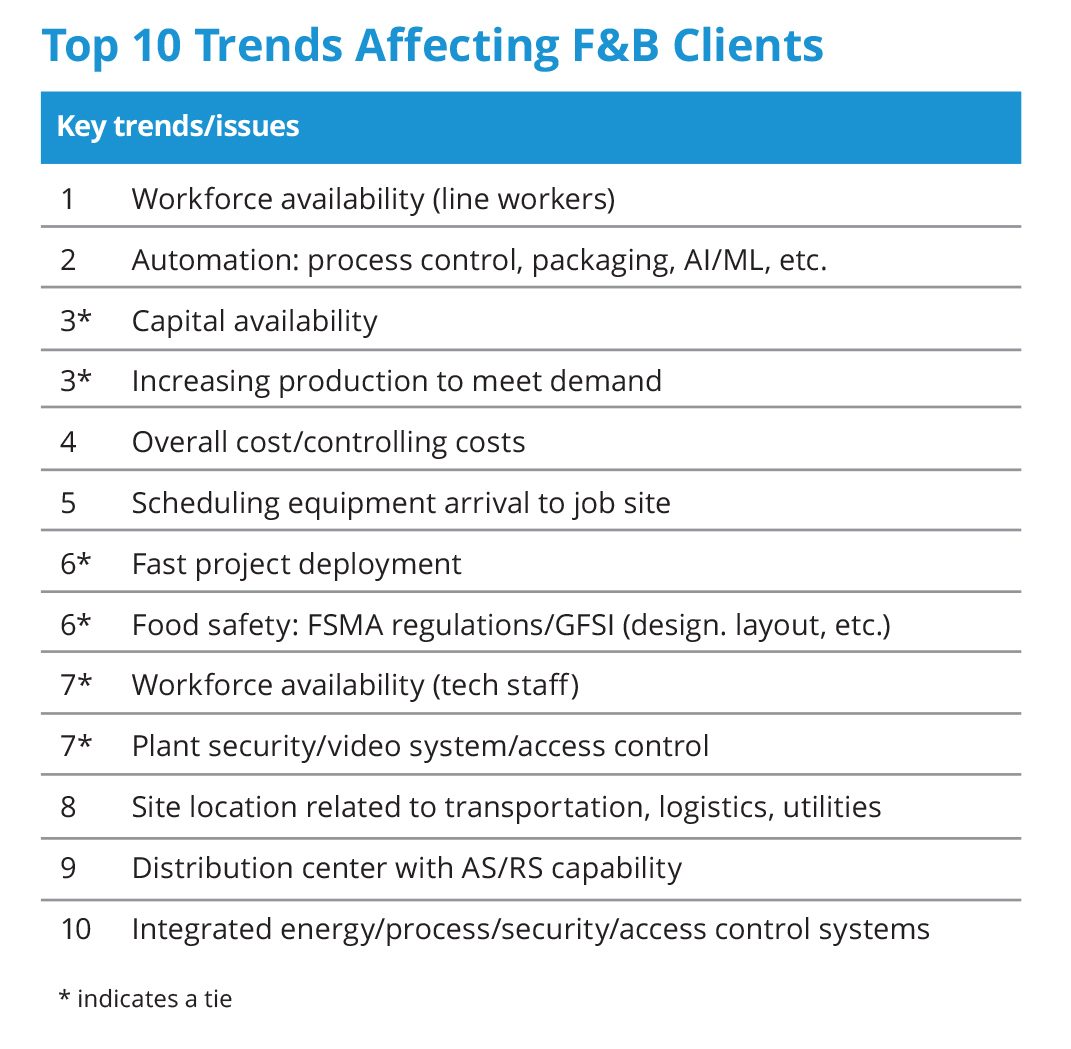

Shown are the top 10 trends affecting food and beverage clients according to AEC firms.

Labor-less Production

The idea of workforce availability has been a common theme for a few years now. It’s definitely one of, if not the most, challenging problems to overcome, including dealing with higher costs. While we may not have seen an overwhelming rush to automate, implementing automation has become a steady constant in food and beverage manufacturing to deal with labor issues.

“The sheer number of people not showing up for shifts and scrambling to staff equipment is forcing owners to invest in automation throughout their facilities to maintain current levels of production,” says Andrew Nelson, VP of business development for ESI Group USA.

Gray Solutions’ Dean Elkins, senior director of robotics & vision, agrees, “Automation can offer a solution to both problems. With more reliable, actionable data streams and automated material handling systems, plant managers can increase produce capacity via enhanced operational efficiency while maintaining or even reducing their labor force.

“As increased labor costs contribute to lower profit margins,” he continues, “manufacturers that invest in automated technology can mitigate the effects of these higher costs. For instance, investments in automated technology can be depreciated over time, and as robotic designs become more robust and refined, maintenance needs are reduced. And while automation can’t lower the cost of raw materials, it can improve accuracy such that scrap and rework rates are reduced, allowing food and beverage processors to gain profit margin at multiple points in the value chain. Operators are using vision systems and optical character recognition to ensure that products are getting put into the right cases, which mitigates potential recalls.” End of Part 1