Make water conservation a part of your business

This mountain lake is actually a reservoir and belongs to the Susquehanna watershed in north-central Pennsylvania, which eventually feeds into the Chesapeake Bay watershed. It provides fresh water to farms, industry and communities. Photo courtesy of Wayne Labs

The United Nations estimates that the global demand for water will increase 20% to 30% by 2050 to meet the food needs of a projected population of 9.8 billion. Food and beverage companies combined with agricultural inputs use the lion’s share of water globally, and nonprofit organization Ceres suggests in a recent study, “Feeding Ourselves Thirsty,” that most food companies are not taking the necessary action to reduce their demands and impacts on freshwater resources.

The mission of Ceres is to research and transform the economy, building a sustainable future for people and the planet. The firm works with influential capital market leaders to find solutions to the world’s greatest sustainability challenges.

According to Ceres’ 2021 research, a benchmark analysis of 38 food and beverage companies shows there are some encouraging signs of progress on corporate water management; however, there is still a lot of room for improvement.

“Food companies are lagging in taking the appropriate water action and fundamentally unprepared for a more water-stressed world,” says Kirsten James, director of water at Ceres. “As ‘Feeding Ourselves Thirsty’ shows, companies must move more quickly and more boldly to value water and better manage the related risks in their direct operations and global supply chains.”

In the benchmark study, the top-scoring companies by industry are Coca-Cola (beverage), Unilever (packaged food), Cargill (agricultural products) and Tyson Foods (meat).

“We are pleased to be this year’s top-scoring company,” says Michael Goltzman, vice president, global policy & sustainability at Coca-Cola. “Our 2030 Water Security Strategy focuses on increasing water security for our business, supply chain and in the communities where we operate. Importantly, we prioritize our investments based on an in-depth understanding of water-related risks at a watershed level, contextualizing our targets to address local risks while focusing on the water used to produce our agricultural ingredients.”

How the study works

The study found that through overall analysis, food companies don’t have adequate practices in place across four categories of water management, including governance structures, risk assessment, target setting and implementation actions.

In the 2021 study, Ceres looked at how food sector companies are responding to water risks and how their performance has changed since the first benchmarking research was conducted in 2015. The analysis evaluated 38 food companies in four food industry sectors with the highest exposure to water risks: agricultural products, beverages, meat and packaged foods.

This group of food and beverage processors includes some of the largest U.S.-based and publicly traded companies plus a number of private and non-U.S. companies. When comparing the water management activities of food and beverage companies, Ceres weighs the above categories as follows: Governance (22 points maximum achievable level), Risk Assessment (28 points), Targets (36 points) and Implementation (14 points). Maximum possible score is 100 points.

Key aspects of governance are corporate board oversight, senior executive oversight, business planning and supplier policies. Risk assessments include analysis and disclosure on water risks for owned operations and agricultural supply chain in high-risk watersheds. Water targets are publicly disclosed, time-bound, quantifiable water-use reduction goals for operations and key agricultural supply chains—and also sustainable agricultural commitments with clear water protection outcomes. Implementation includes educational and direct/indirect financial support for growers and collaborative actions to protect key high-risk watersheds.

In the benchmark study, the top scoring companies by industry are Coca-Cola (beverage), Unilever (packaged food), Cargill (agricultural products) and Tyson Foods (meat).

“Food companies are lagging in taking the appropriate water action and fundamentally unprepared for a more water-stressed world.”

—Kirsten James, director of water, Ceres

The 2021 report includes updated methodology and some changes in scoring to make sure the scores reflect the most relevant aspects of companies’ water risk management and align with global standards that investors rely on.

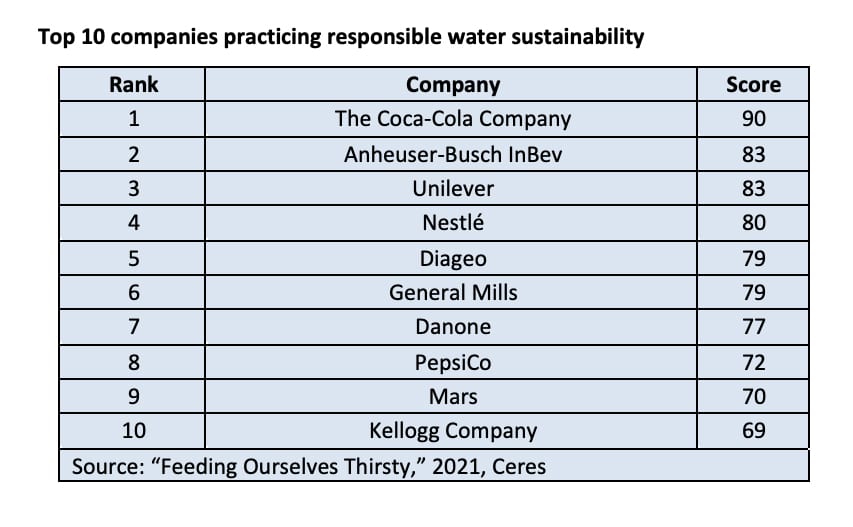

2021 company ranks and scores

The 2021 research showed steady improvements in water stewardship based on information companies supplied to show evidence of programs and goals to increase water quality and efficiency in their own operations and in their supply chains. The average overall score in this year’s report was 45 points, with packaged goods and beverage sectors achieving the highest scores, followed by agricultural and meat sectors.

This year’s top 10 were (in decreasing scores): The Coca-Cola Company (90 score), Anheuser-Busch InBev (83), Unilever (83), Nestlé (80), Diageo (79), General Mills (79), Danone (77), PepsiCo (72), Mars (70) and Kellogg Company (69).

Among the key improvement trends, 79% of the companies’ boards have explicit oversight over sustainability-related issues, a 44% improvement from 2017. More than half (53%) of the companies link executive compensation to water performance goals, a 60% leap from 2019; and 42% have a watershed protection plan for their agricultural supply chain, a 50% improvement from 2019. And, 55% of the companies provide financial incentives to farmers to encourage adoption of practices to reduce water use and impact, a 60% jump from 2019.

There is still work to be done. Only a small number of companies (17) disclosed a supplier policy that includes specific expectations regarding water usage and quality. Only eight companies demonstrated policies that define protocols of non-compliance. Eighteen companies (less than half surveyed) performed robust water risk assessments (inclusive of water quality) that focus on their agricultural supply chains. Only nine companies have implemented water use reduction targets for key growing regions in their supply chains. Finally, only a dozen companies focused on their direct or indirect financial support for farmers growing key ingredients in high-stress water basins. FE