Food Manufacturing

State of

In 2020, respondents to Food Engineering’s annual State of Food Manufacturing survey were focused on responding to the COVID-19 pandemic, with it affecting everything from current operations to long-term planning to supply chains to staffing levels.

One year later, not much has changed. While processors have seen demand normalize and supply chains stabilize, the pandemic still dominates responses to the annual snapshot of where the food and beverage industry is and where it’s going.

Conducted by Clear Seas Research, a B-to-B market research company, the survey shows an industry that navigated the worst of the pandemic, yet is still trying to adapt to it. So let’s take a step back to view the way forward, by looking at how results have changed from 2019 (when COVID wasn’t on anyone’s radar) to 2020 (the height of the pandemic) to now.

Casey Laughman, Editor-in-Chief

Photo courtesy of Getty Images/Oksana Kuznetsova

COVID-19 pandemic continues to dominate current, future plans for processors

Throughput

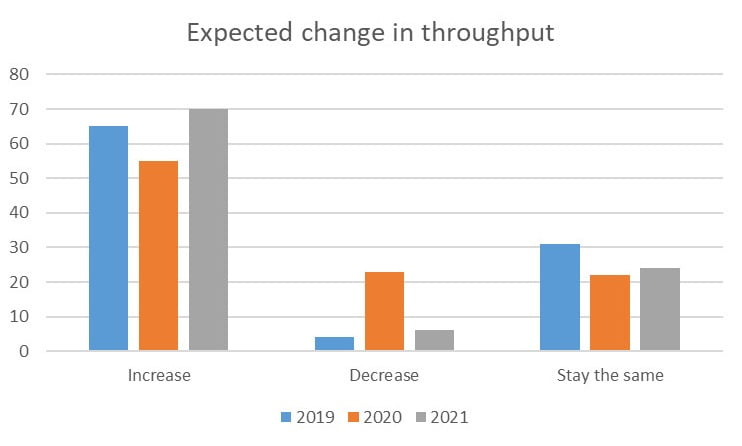

One of the cornerstone questions of the State of Food Manufacturing survey is whether respondents expect their throughput to change over the next year. In 2019, 65% of respondents said they expected it to increase, while 31% said it would stay the same and 4% expected a decrease. In 2020, 55% of respondents said increase, 22% said stay the same and 23% said decrease. This year, 70% of respondents said increase, 24% said stay the same and 6% said decrease. Among the 2021 respondents who said they expected to see an increase, 33% said it was related to COVID-19.

While that may seem like 2020 was a temporary blip and 2021 is a return to normal, remember the context of 2020: Retail demand was through the roof, while foodservice demand was almost non-existent. In 2020, the mean expected decrease in throughput was 30%, showing that those respondents who expected a decrease were forecasting a major drop in demand.

This year, with schools reopening, more people dining out and crowds returning to sporting events, foodservice demand has returned while retail demand has normalized after a stretch of grocery store shelves being cleaned out as consumers stocked up during the height of the pandemic.

One other interesting aspect of this category is the “stay the same” number. While 2020 and 2021 were pretty close to the same, they were down significantly from 2019, which shows that the last couple years had processors expecting more volatility. While that was to be expected in 2020, it’s a sign that 2021 respondents aren’t certain just yet that things are back to normal.

Top trends

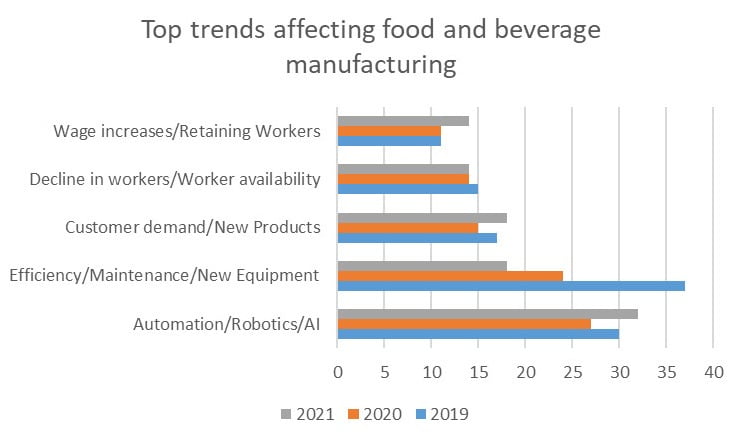

When respondents were asked to rank the top trends they expect to shape the next five years of food and beverage manufacturing, 2021 saw the same top trends as 2020 and 2021. The top five of 2021:

1. Automation/Robotics/AI, 32%

2. Efficiency/Maintenance/New Equipment, 18%

3. Customer Demand/New Products, 18%

4. Decline in Workers/Worker Availability, 14% and

5. Wage Increases/Retaining Workers, 14%

These trends are mostly the same over the last three years, with a couple of interesting exceptions. While “COVID Safety Measures” was the No. 6 trend this year, “COVID related mentions” was the No. 2 trend in 2020, while “COVID Safety Measures” was No. 6.

In 2019, of course, COVID-19 was nowhere to be found. But the No. 4 trend that year was Clean label/Healthy foods, which dropped all the way to No. 12 in 2020 before rebounding to No. 8 in 2021. As many processors experienced, consumers wanted comfort food if they were going to be stuck at home, and either through lack of availability or consumer choice, health concerns were not as much of a priority in 2020 as they have been in other years.

The trends question is an open-ended one, which allows for respondents to share specific thoughts about how they see the industry changing. Respondents are granted anonymity in order to speak freely, and a couple of responses from the 2021 survey stick out as examples of how COVID has changed and will continue to change the industry.

A small sample of some of the responses:

“COVID impacts will continue to change the marketplace. Things like drive-up and delivery are here to stay, which really impacts refrigerated goods in terms of shipping and refrigerated storage.”

“Supply chain logistics recovery from COVID-19 issues are estimated to take 2 years to return to normal stability in some areas. This unpredictability will surprise many I feel.”

“Working-from-home positions will impact how we have to work to hire and retain employees.”

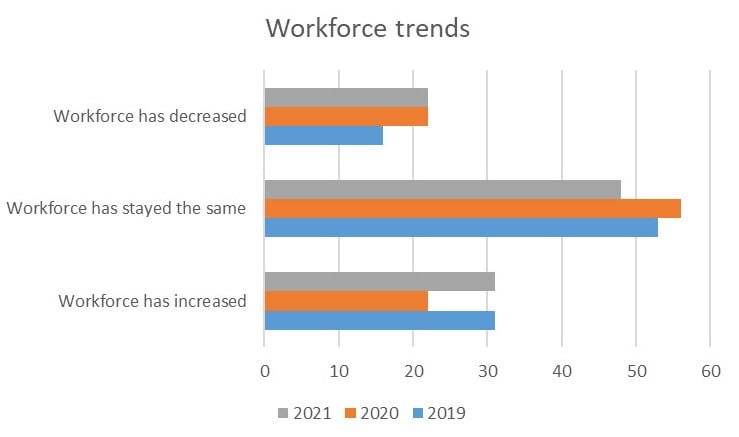

Respondents to all three years’ worth of surveys report a similar breakdown of whether their workforce has increased, decreased or stayed the same. But there’s a big red flag in the responses to whether their current location is full-staffed or understaffed. In 2019, 60% of respondents said they were full staffed. In 2020, 58% said they were full staffed. But in 2021, that number has dropped to 50%, a significant downturn. Of those who say they are understaffed, 70% report that overtime is being used to fill the gaps, while 56% report changes in shifts or production schedules.

As for how processors are trying to find and keep employees, the methods are similar across all three years. Each year, “more training” and “increased wages” were the top two responses, with at least 40% reporting both.

Finding and retaining workers

The food and beverage industry has been facing labor shortages and skills gaps for several years. Finding, training and retaining qualified workers for everything from the production line to engineering management issues has been a challenge, as a tight labor market and an aging industry workforce have led to processors losing institutional knowledge and scrambling to replace it.

The food and beverage industry has been facing labor shortages and skills gaps for several years.

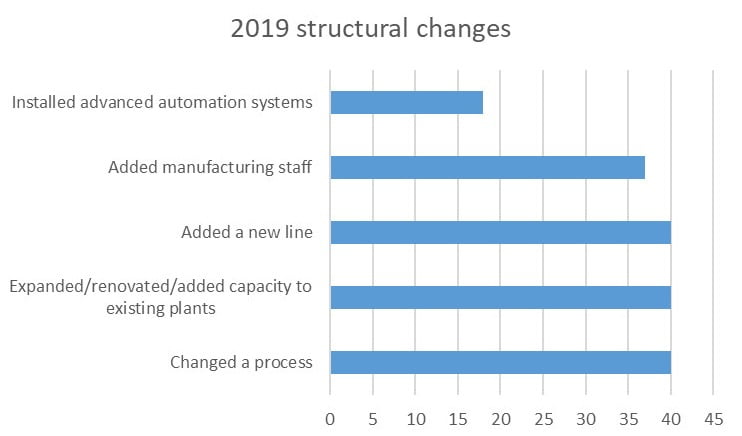

And in 2019:

1. Changed a process

2. Expanded/renovated/added capacity to existing plants

3. Added a new line

4. Added manufacturing staff

5. Installed advanced automation systems

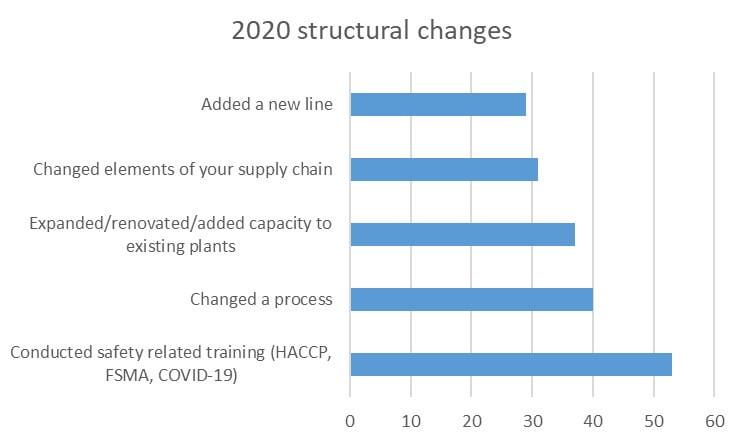

In 2020, they were:

1. Conducted safety related training (HACCP, FSMA, COVID-19)

2. Changed a process

3. Expanded/renovated/added capacity to existing plants

4. Changed elements of your supply chain

5. Added a new line

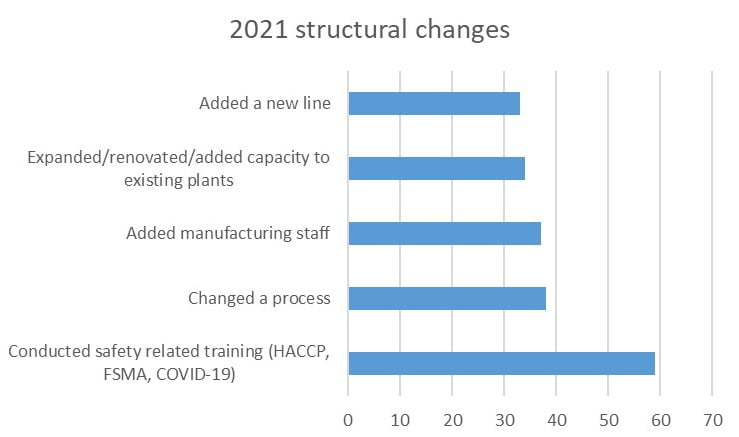

Structural changes

As is the case with many of the categories, the structural changes implemented by food and beverage processors has not varied by a lot over the last three years. The top five this year were:

1. Conducted safety-related training (HACCP, FSMA, COVID-19)

2. Changed a process

3. Added manufacturing staff

4. Expanded/renovated/added capacity to existing plants

5. Added a new line