July 2022

The State of

Food Manufacturing in 2022

Our 43rd annual report highlights the trends and challenges shaping the industry today

Photo courtesy of Getty Images / sykono

Back in 2020 one of the frequently used catchphrases in the industry was “the new normal” to describe pandemic-related chaos up and down the supply chain. Many processors waited patiently for that new normal to disappear, and the pre-2020 paradigm to return to its rightful place.

However, in 2022, it appears the previous status quo for food processing and logistics, along with ingredients, supplies, labor, construction and more, might be long gone. In its place is a constantly shifting reality involving all the components necessary to build and operate food production facilities, but rarely in sync with each other.

In order to understand what factors are shaping the industry today and what obstacles operators face in 2022, Clear Seas Research, a B2B market research firm, recently surveyed processors about a wide range of today’s industry challenges, and here are some of the highlights from that report.

Michael Costa, editor-in-chief

Throughput

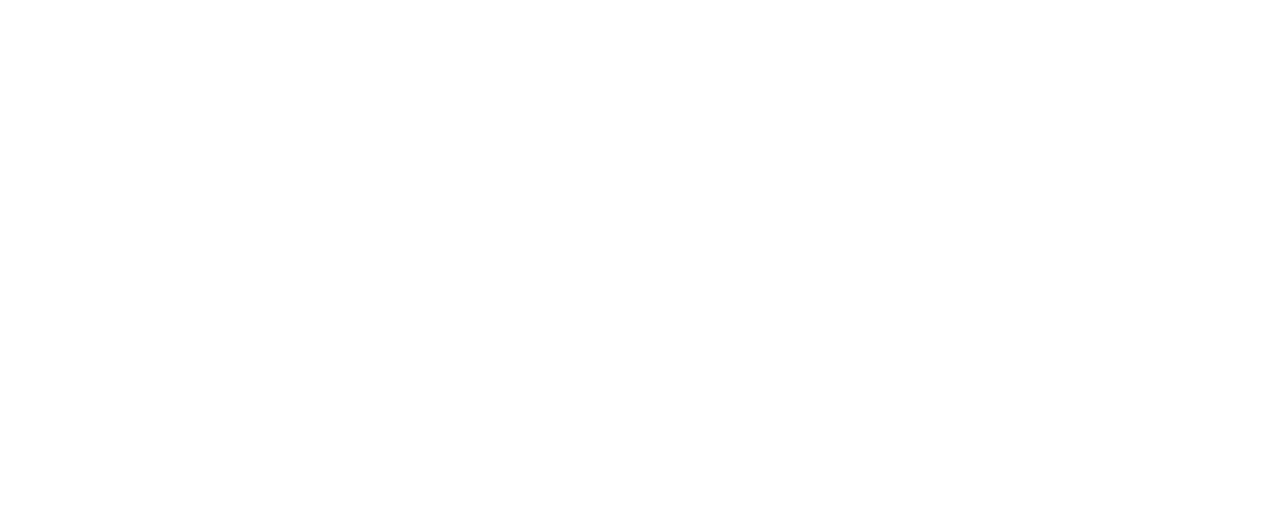

Of those surveyed, 67% say gross throughput in 2022 increased by an average of 24%, a 2% increase over 2021. About one-third of respondents (31%) reported staying the same, up from 24% last year. The overall numbers are very similar to 2021, but the reasons for an increase in throughput are not.

In 2021, the top reason (33% of respondents) for increased throughput was related to the pandemic. In 2022, COVID-related throughput was cited near the bottom at 4%. The top reason for increased throughput (39% of respondents) in 2022 is increased sales due to new customers and new business, with overall demand driving throughput for 33% of those surveyed.

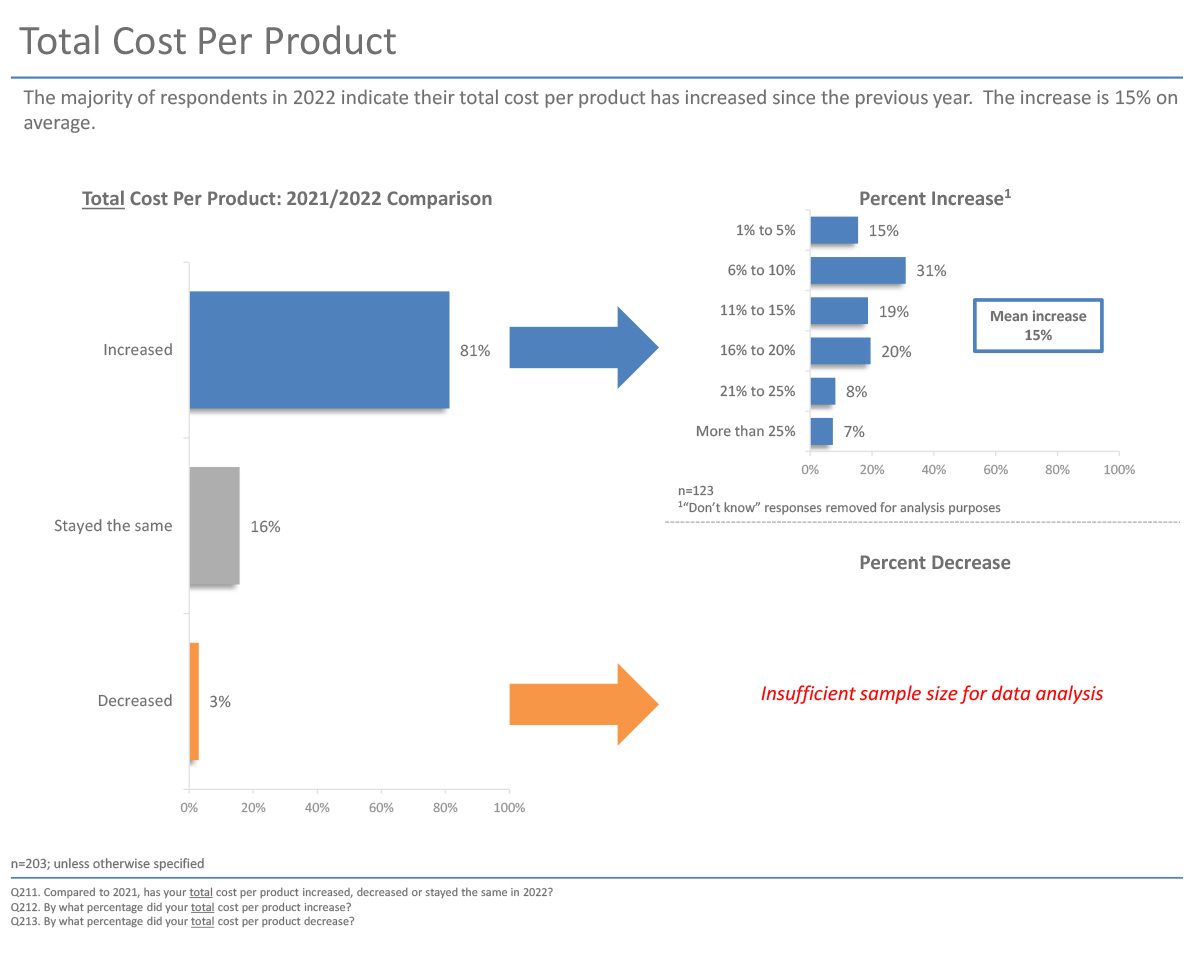

Inflation and Cost per Product

Inflation is impacting all areas of the industry right now, and current survey results reflect that. The total cost per product increased from approximately 11% to 15% year-over-year. Of those surveyed, 52% reported an increase in cost per product in 2021, and that number has skyrocketed to 81% this year. Correspondingly, 42% of last year’s participants reported cost per product stayed the same, and that number dropped to 16% this year.

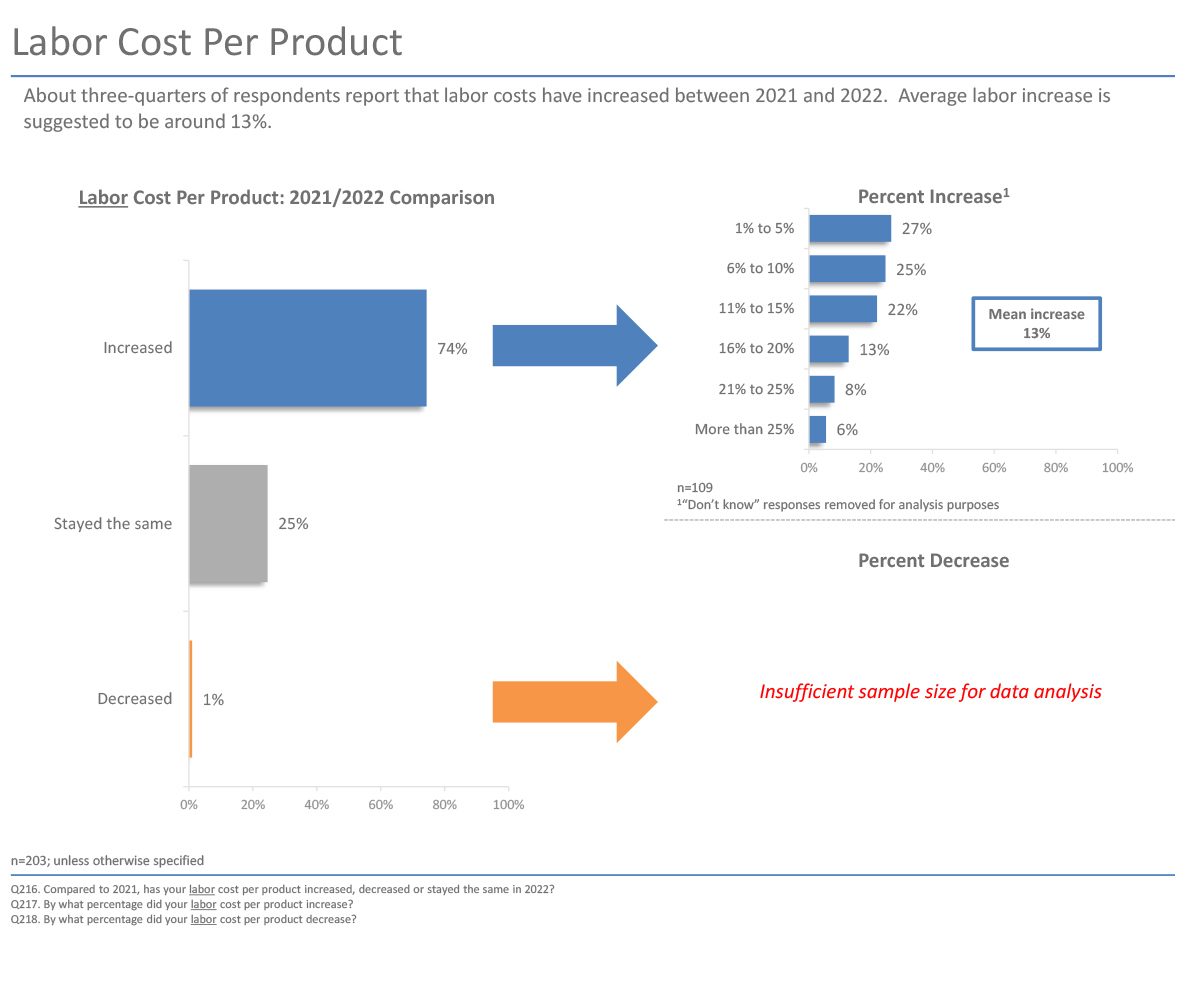

Breaking this category down further, labor factored into the equation accounted for an 11% increase in 2021, and that went up to 13% this year. However, 47% of respondents in 2021 reported labor cost per product as increasing, and that number shot up to 74% this year. In 2021, 47% of those surveyed said labor cost per product stayed the same, while that number dropped to 25% in 2022.

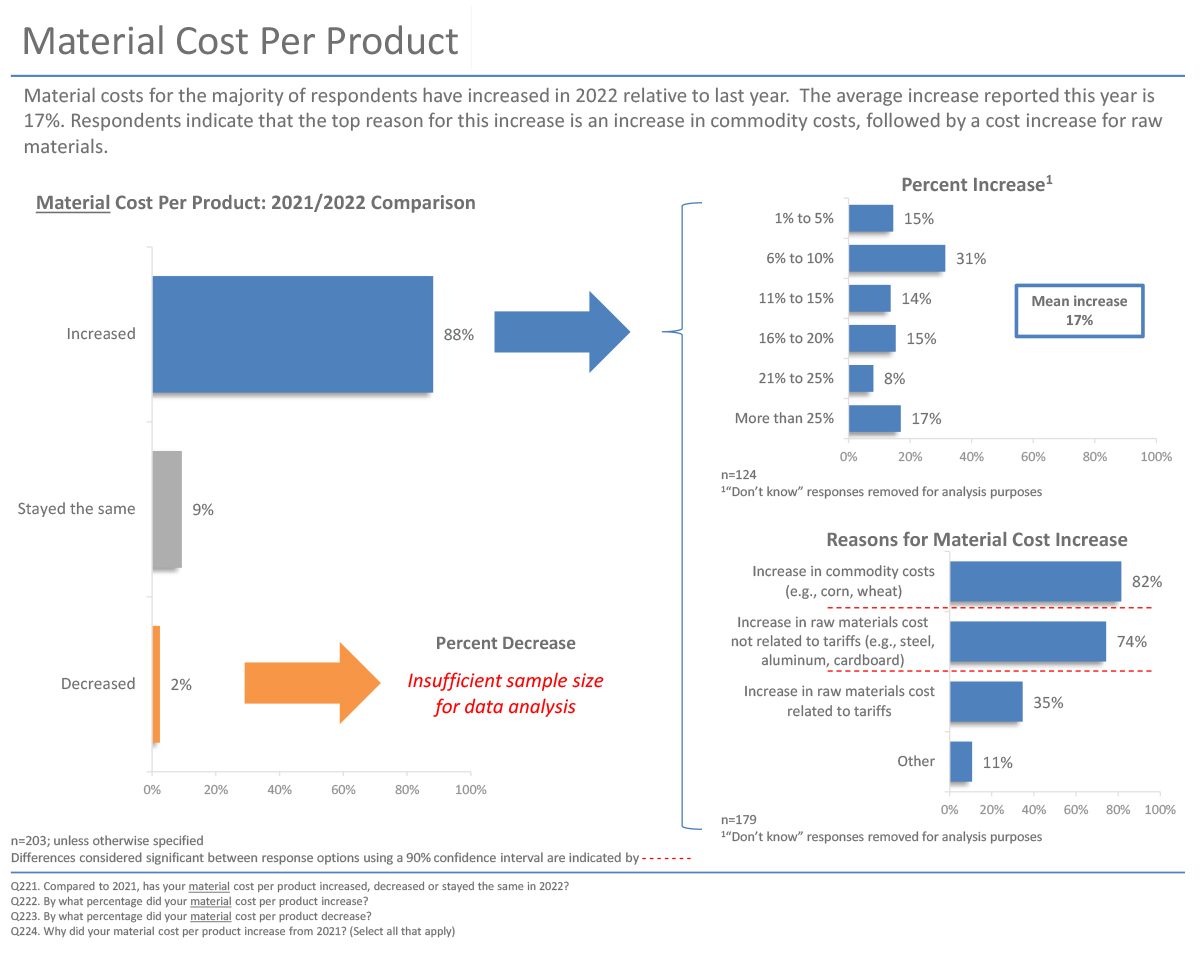

Material cost per product in 2022 is the most reflective of today’s inflation concerns. Last year, material cost per product increased by 11%. This year, that number is at 17%. In 2021, 67% of respondents reported an increase in material cost per product, and that number is 88% today. Diving deeper, an increase in commodity prices for ingredients like corn and wheat is the top factor driving the uptick in this segment, while raw material costs like steel, aluminum and cardboard is a close second.

Preventing Control Management

As mentioned earlier, the supply chain remains an unpredictable element for food processors, and this year’s results show it’s more confounding than ever. When asked what factors make preventive control management more difficult, 45% said supply chain consistency, up from 30% last year. Sanitation was cited by 14% of respondents, down from 20% in 2021. While the supply chain continues to be difficult, it appears operators that invested in food safety and sanitation initiatives during the pandemic are realizing the benefits today.

Cybersecurity

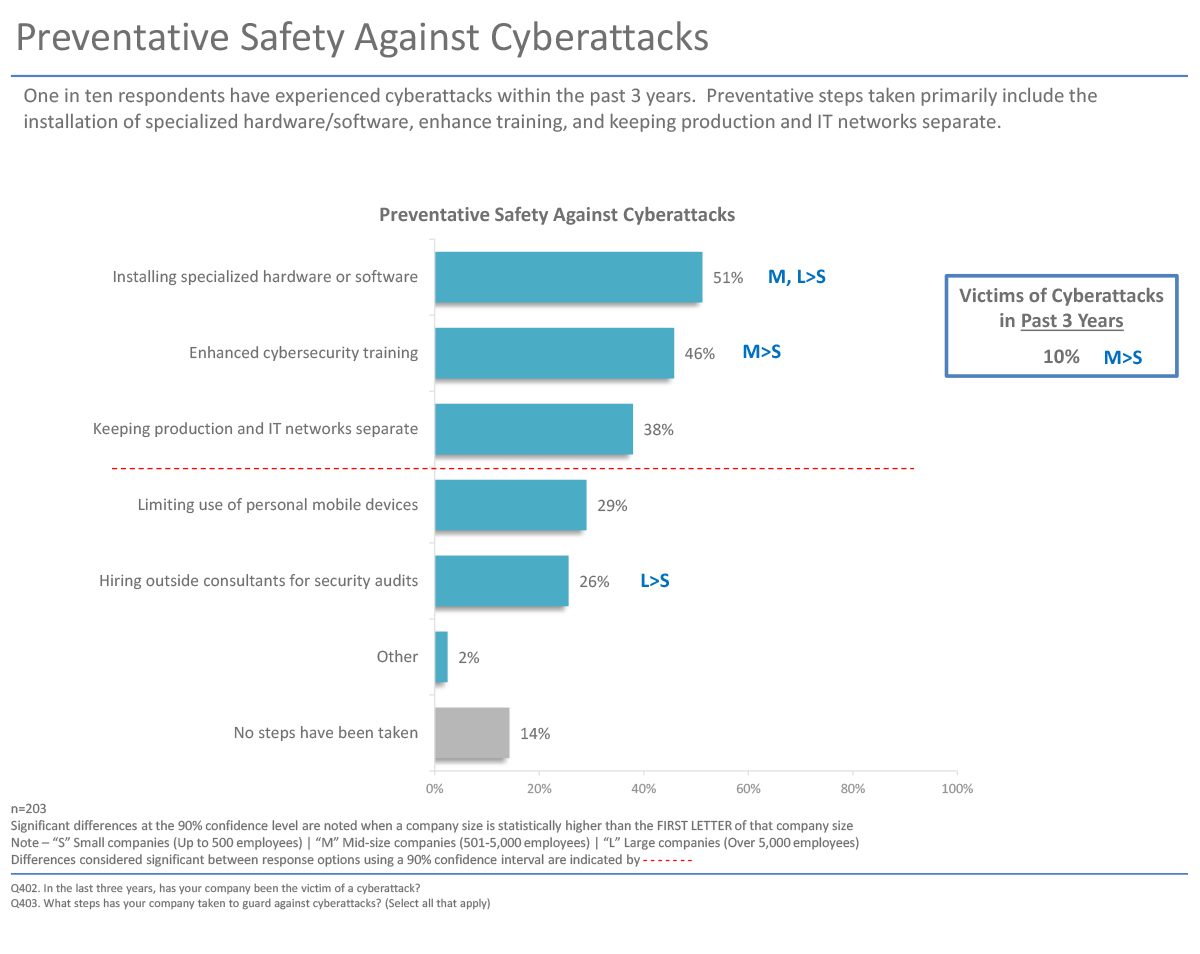

Another area difficult to control and a hot topic within processing facilities is cybersecurity. Of our respondents this year, 1 in 10 say they’ve experienced a cyberattack within the past three years, and have taken steps recently to counter additional attacks, including installing specialized hardware or software (51%), adding enhanced cybersecurity training (46%) and keeping their production and IT networks separate (38%).

Improving Productivity

Those surveyed this year also cite additional needs to improve overall productivity in their operations, including:

• 80% looking at equipment upgrades (21% of those say this is a great need)

• 78% interested in improving supply chain management (22% say this is a great need, up from 11% last year)

• 61% want to increase flexibility on existing production lines (11% say this is a great need)

• 59% plan to expand or retrofit their food processing plants (14% say this is a great need). Additionally, 55% say they want to expand their packaging lines (a great need for 15%) and production facilities (18% say this is a great need).

Overall Trends and Labor

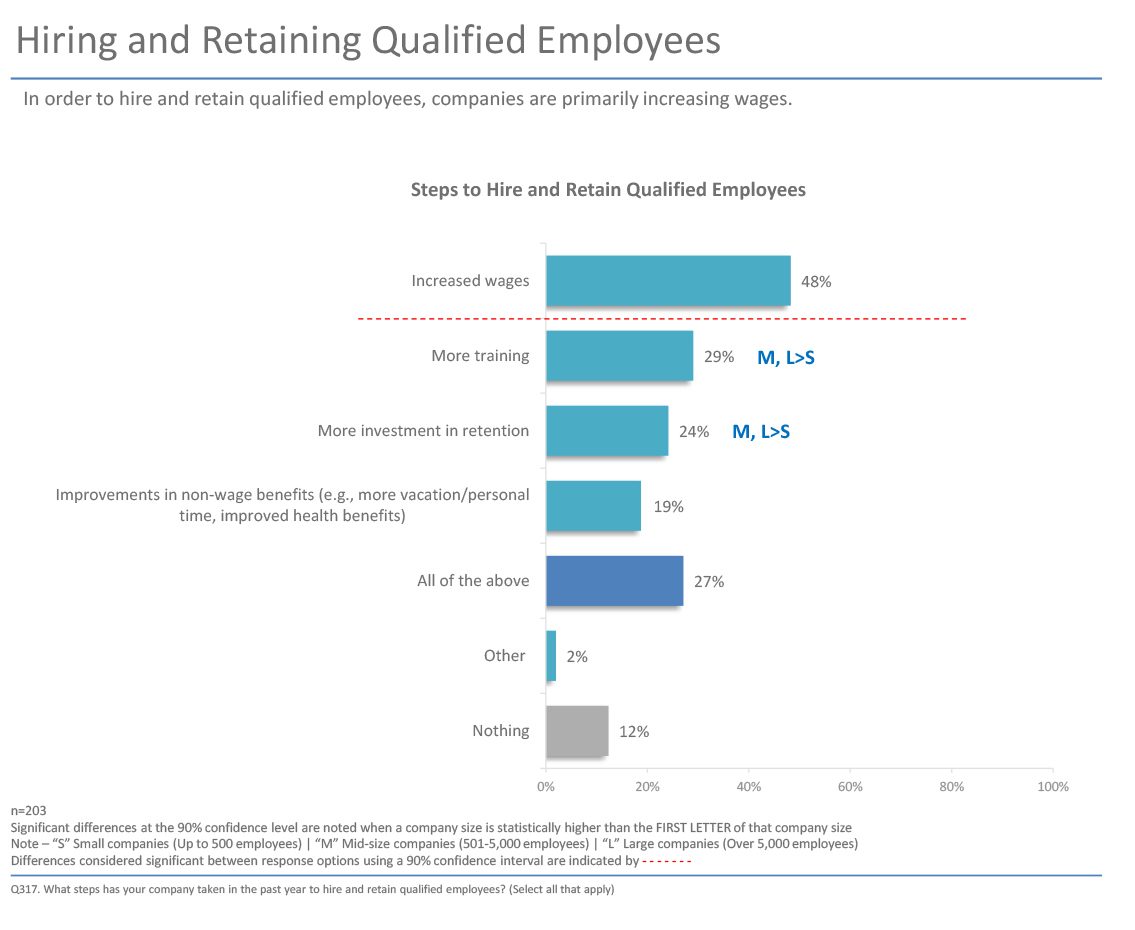

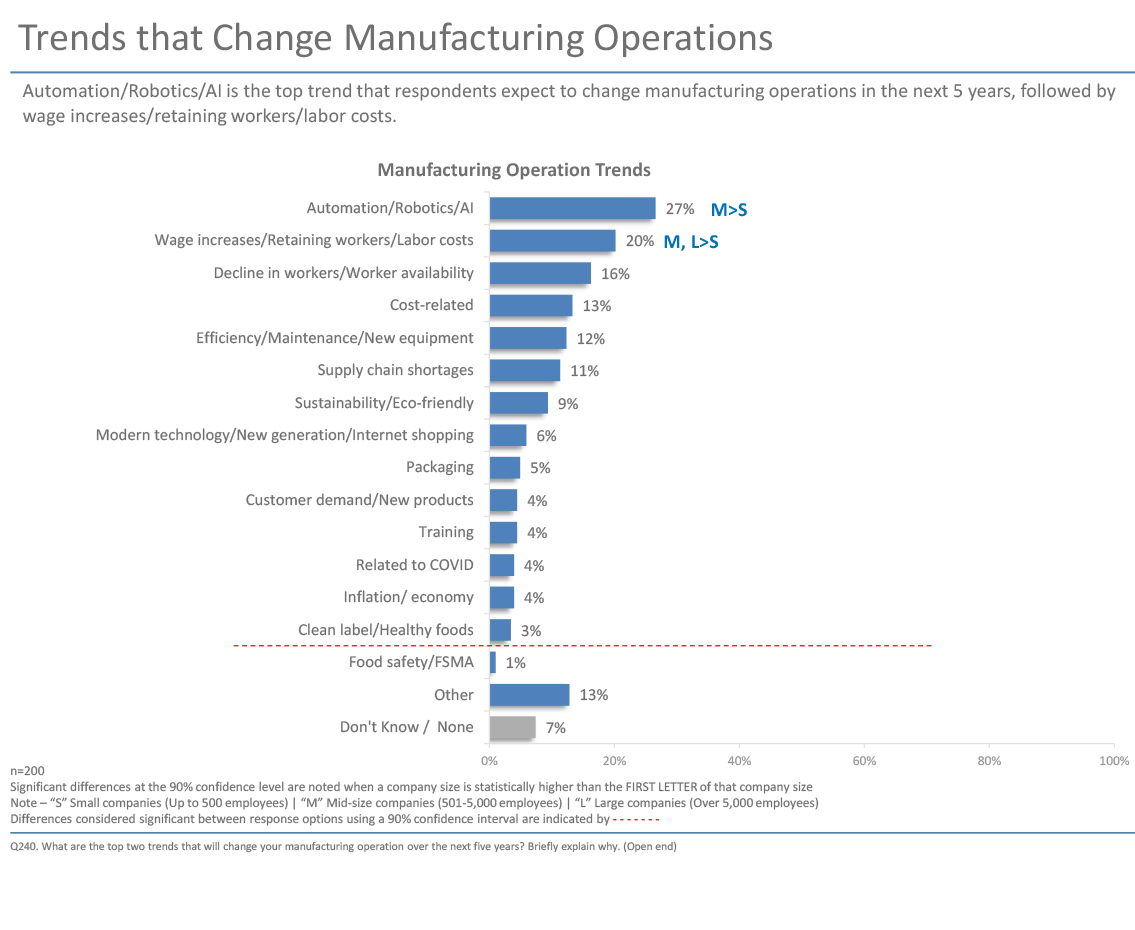

Several respondents (27%) rated automation/robotics/AI as the number-one trend in the industry right now, and (perhaps predictably) right behind it, are concerns about labor, since automation is seen as a possible panacea to a perpetually shrinking labor pool: 20% say wage increases/retaining workers/labor costs are impacting their operations (up from 14% last year), while 16% cite a decline in workers/worker availability.

The impact of COVID-related initiatives fell to 4% among those surveyed, down from 7% last year. Meanwhile, supply chain shortages (11%) increased as a trend, up from just 4% in 2021.

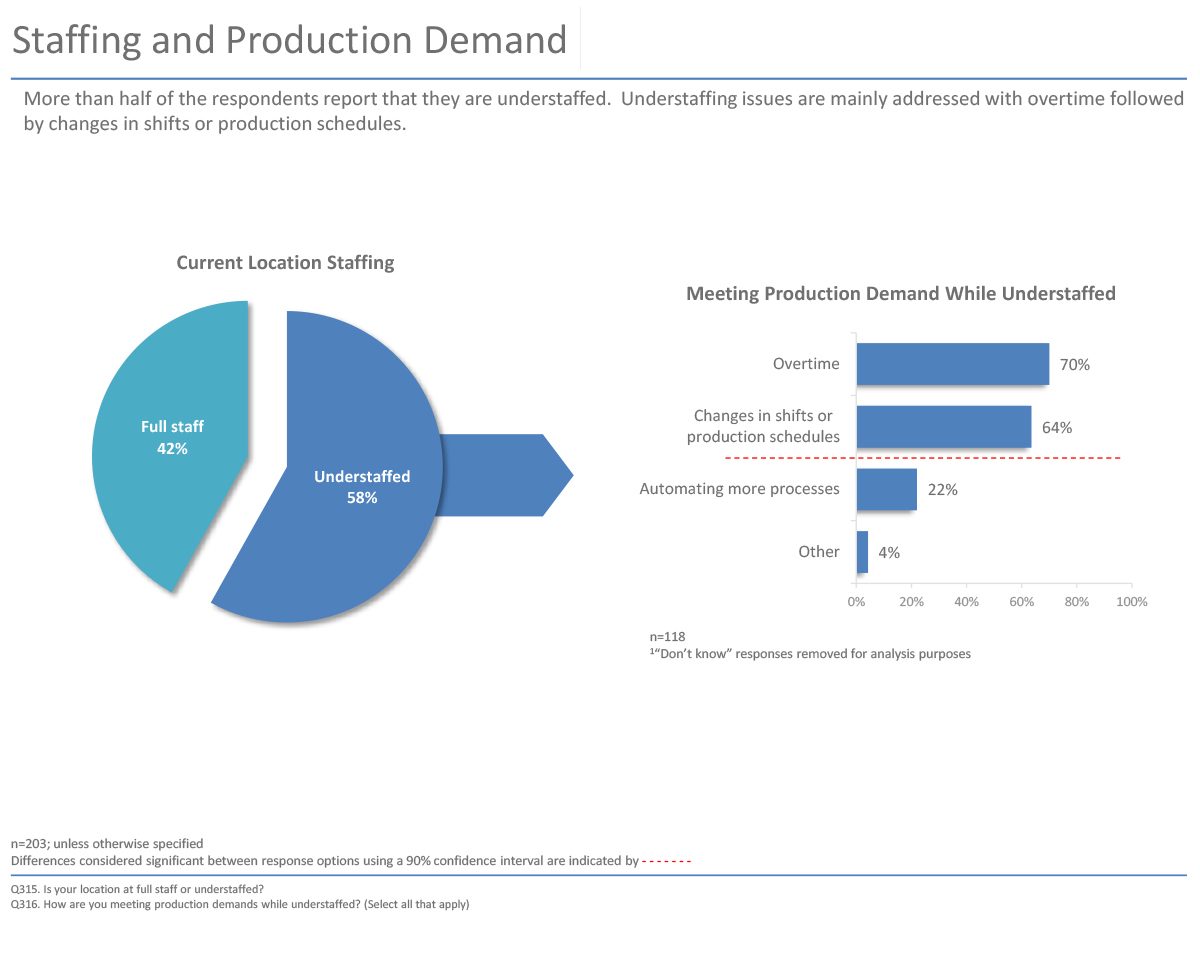

Detailing labor concerns further, 42% of respondents say they’ve increased their workforce, up from 31% a year ago, primarily due to business demand and company growth. However, that growth may be outpacing the available labor pool, as 58% of those surveyed say they are currently understaffed, up from 50% in 2021.

How processors are handling workforce woes points to where the industry is likely heading. While 70% added overtime for existing employees (the same as last year), changes in shifts or production schedules increased from 56% to 64% compared to 2021, while automating more processes jumped to 22%, up from 14% last year. While the labor shortage isn’t going away, processors that continue investing in automation, line flexibility and smart technology can close that gap a little more each year. FE

Clear Seas Research. 2022 Food Engineering State of Food Manufacturing, July 2022.

Clear Seas Research is a full service, B-to-B market research company focused on making the complex clear. Custom research solutions include brand positioning, new product development, customer experiences and marketing effectiveness solutions. Clear Seas offers a broad portfolio of primary, syndicated research reports and powers the leading B-to-B panel for corporate researchers, myCLEARopinion Panel, in the architecture, engineering, construction, food, beverage, manufacturing, packaging and security industries. Learn more at clearseasresearch.com.

To learn more about the report and purchase, just click here.

JULY 2022