— 44th —

Plant Construction

survey

Pandemic spawns solutions to supply chain and processing woes

June of last year saw some pretty grim responses to the COVID-19 pandemic: Shut-down plants, broken supply chains, input shortages to food plants, scattered protein outages, closed restaurants and food service facilities—and people working at home, placing an unfathomable demand on grocery and big-box stores, their distributors and supply chains.

Here we are a year later, having learned some lessons the hard way—and the results of this year’s annual plant construction survey certainly point to the resilience and agility of our industry and its suppliers to respond to changing needs and requirements. Especially, kudos go out to the A&E/C (architectural and engineering/construction) firms who kept working on necessary and vital projects when states closed projects and facilities.

Last year, Mark Galbraith, co-owner of GALBRAITH Pre-Design, had reported: “In Pennsylvania, the deeming of construction as non-life essential has hurt construction projects across the board. Other than maintenance (in order to keep facilities in compliance with food safety regulations), projects are shut down.”

While the food sector remained strong during the pandemic, decision making on construction projects was initially affected due to work at home and redirecting staff to mitigation work, says Darrin McCormies, Epstein senior vice president, director of industrial services. “Many of our clients in the meat industry have initiated physical changes to their high-density areas to create social distancing and as a result, more projects relating to renovation and expansion of employee welfare areas were undertaken.”

Wayne Labs, Senior Technical Editor

Fortunately, most food and beverage projects have gone on, though challenges remain—such as getting materials and equipment delivered to site on time as well as commodity price escalation, says Dan Oberlies, VP, market leader at Alberici Constructors.

Even so, the results in this year’s Food Engineering Annual Plant Construction Survey seem to show a strong response to righting the faltering supply chains and physical plants that were simply no longer able to keep up with product flow, human movement and social distancing. Hence, this year’s numbers show a huge increase in the number of fulfillment and distribution centers/warehouses and a significant increase in building new greenfield facilities, and renovating and rebuilding on brownfield sites where space is ample.

What’s driving all the activity? Tyler Cundiff, president of the Food & Beverage Market at Gray Inc., offers a few thoughts: manufacturing enterprise consolidation, increased focus on food safety upgrades, as well as dynamic and growing global consumer demands. “However, much of the current new project activity is a result of a drastic disruption to the global food supply and delivery system due to COVID-19.”

Though this year marks the 10-year anniversary of the passage of the Food Safety Modernization Act, most A&E/Cs report that recent projects already incorporate FSMA, so most of the issues driving projects have been directly related to A&E/Cs and processors adjusting their efforts, plants and distribution centers (DCs) to keep up with changing consumer demands brought about by COVID-19. In fact, Greg Marconnet, vice president at Mead & Hunt, says the focus is on speed to market and increasing automation, driven by the availability (or lack thereof) of labor and pandemic risk management.

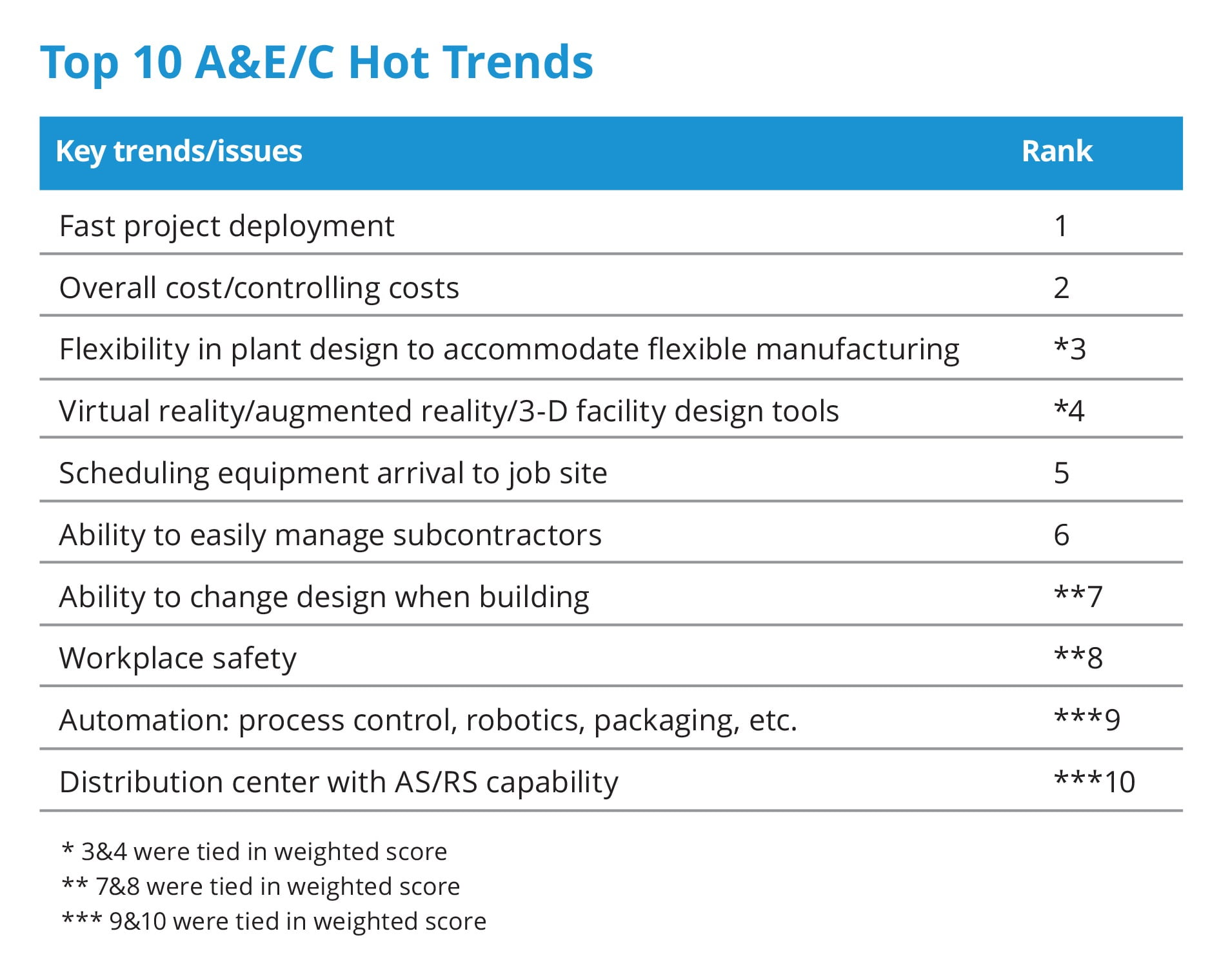

Polling this year to see what’s driving A&E/C firms and their food and beverage customers no longer puts FSMA at the top of the list. Rather, for A&E/Cs, the top three drivers were fast project deployment, controlling costs and being flexible in plant design to accommodate quick manufacturing changes. (See “Top 10 A&E/C Hot Trends.”)

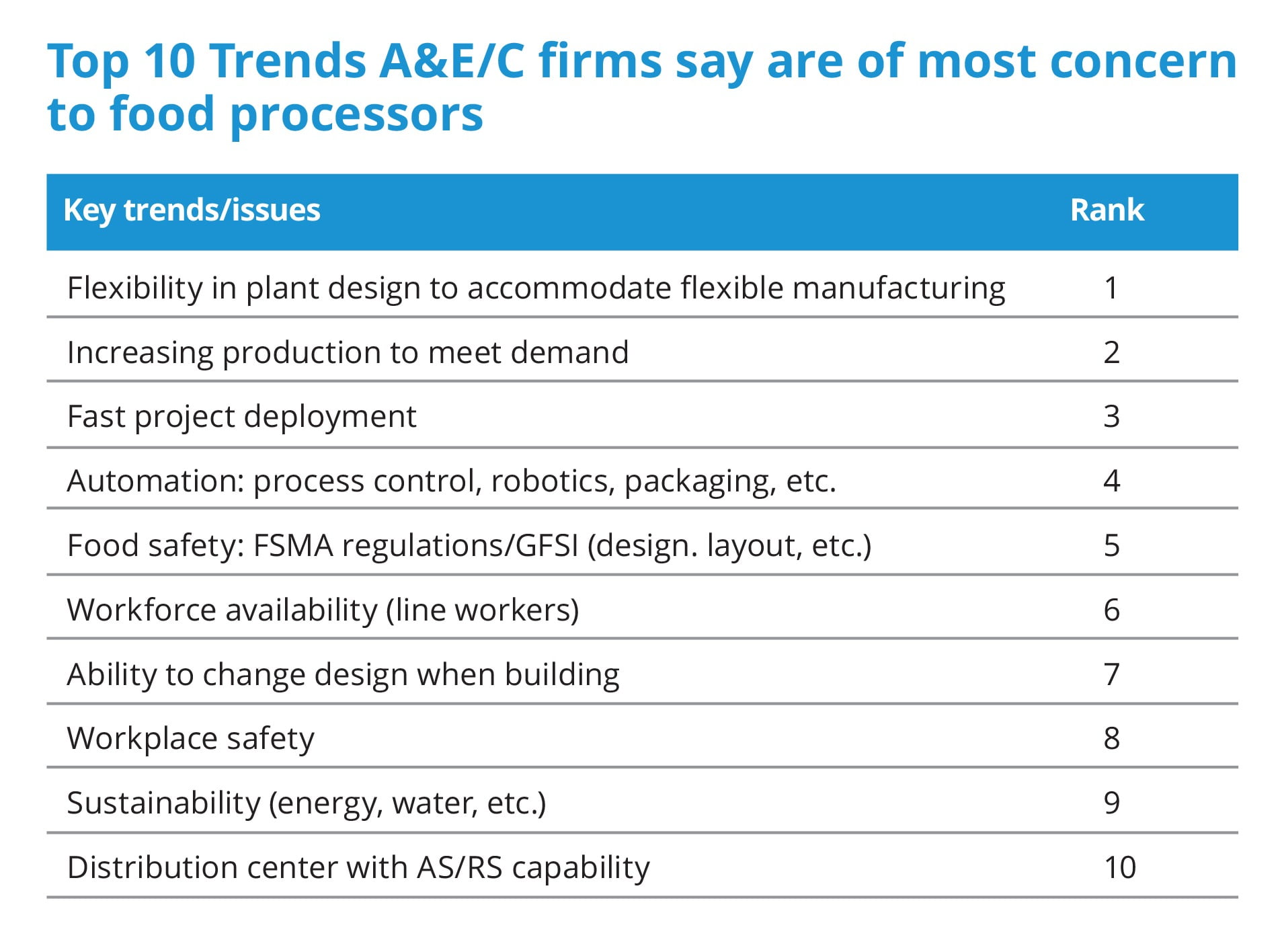

According to A&E/C firms, processors and DC operators pretty much have FSMA under wraps, but their top three concerns are designing plants to accommodate flexible manufacturing, increasing production to meet demand and having fast project deployment. After automation at fourth priority is FSMA, and not far behind is workforce availability, which has been a perennial problem for engineering firms as well. (See “Top 10 Trends A&E/C firms say are of most concern to food processors.")

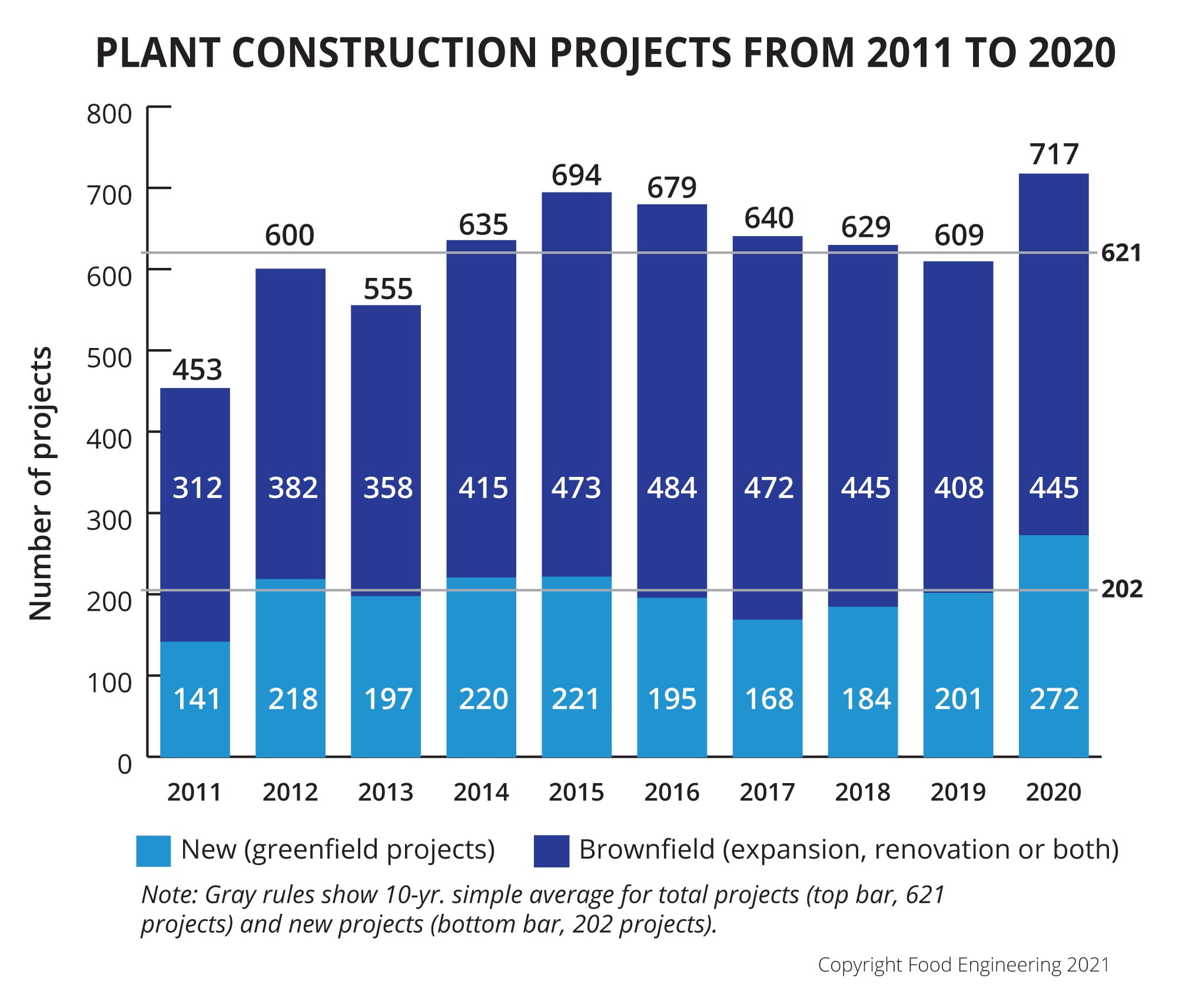

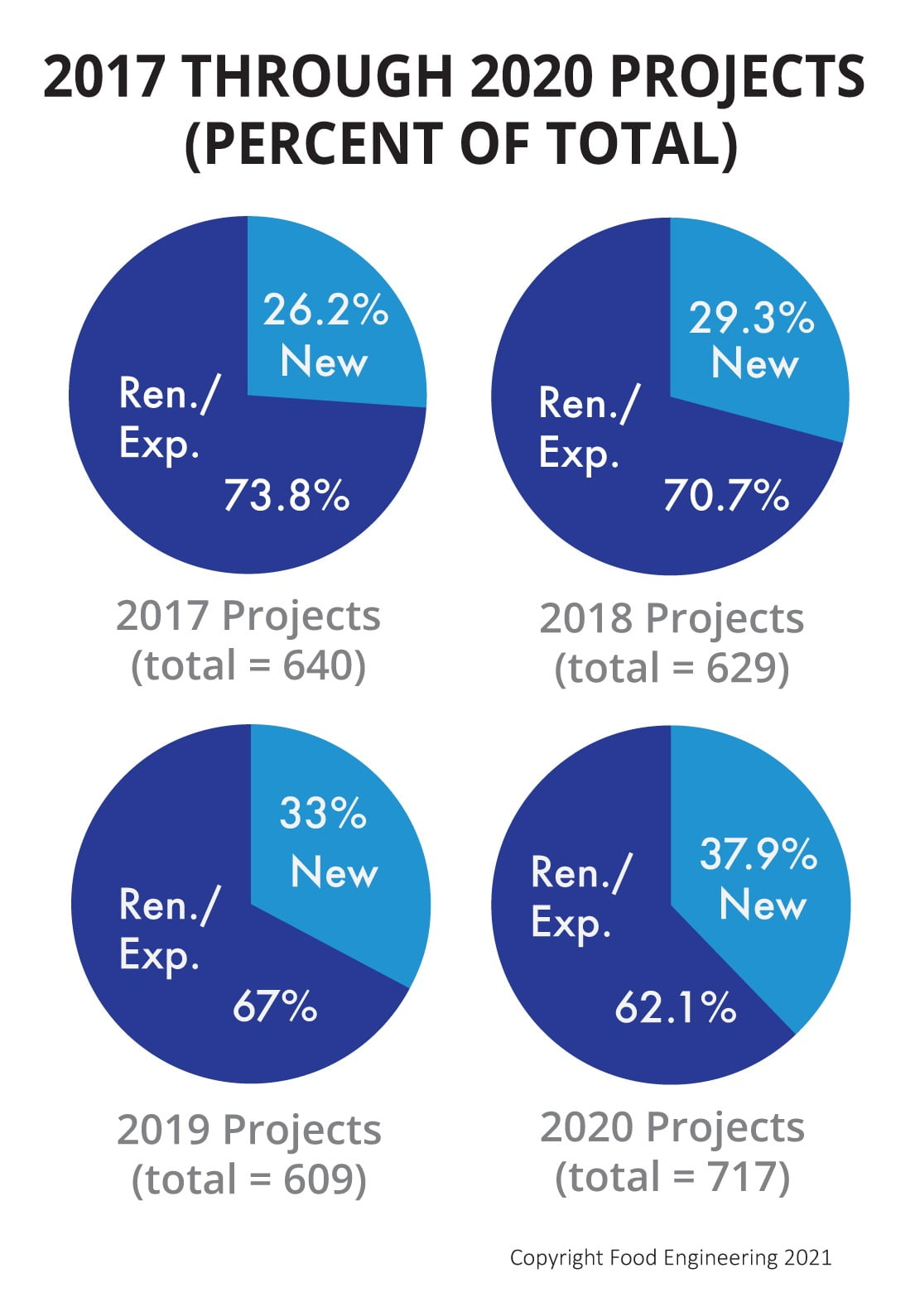

Since 2015, the total number of projects seemed to be tapering off a little, though this could be due to reporting and searching inaccuracies. However, 2020 changed the trend big time. (See the chart, “Plant construction projects from 2011 to 2020.”) Compared to the 10-year, simple average this year’s survey shows that the total number of reportable food and beverage projects is 15.4% above the yearly average of 621; the number of new projects (272) is 34.9% above the 10-year average of 202 projects; and 445 plant expansions and renovations exceed the 10-year average of 419 by about 6%.

What the numbers show

Food Engineering’s 44th Annual Plant Construction Survey revealed a total of 717 reportable food and beverage-related projects, 17.7% higher than last year’s number of 609. New projects counted for 272, or 37.9% of this year’s total, and are 35.3% higher than last year’s number of 201 reported new projects. Plant renovations and expansions accounted for 445 projects, or 62.1% of total projects reported for 2020; that is 9.1% higher than last year’s number of 408.

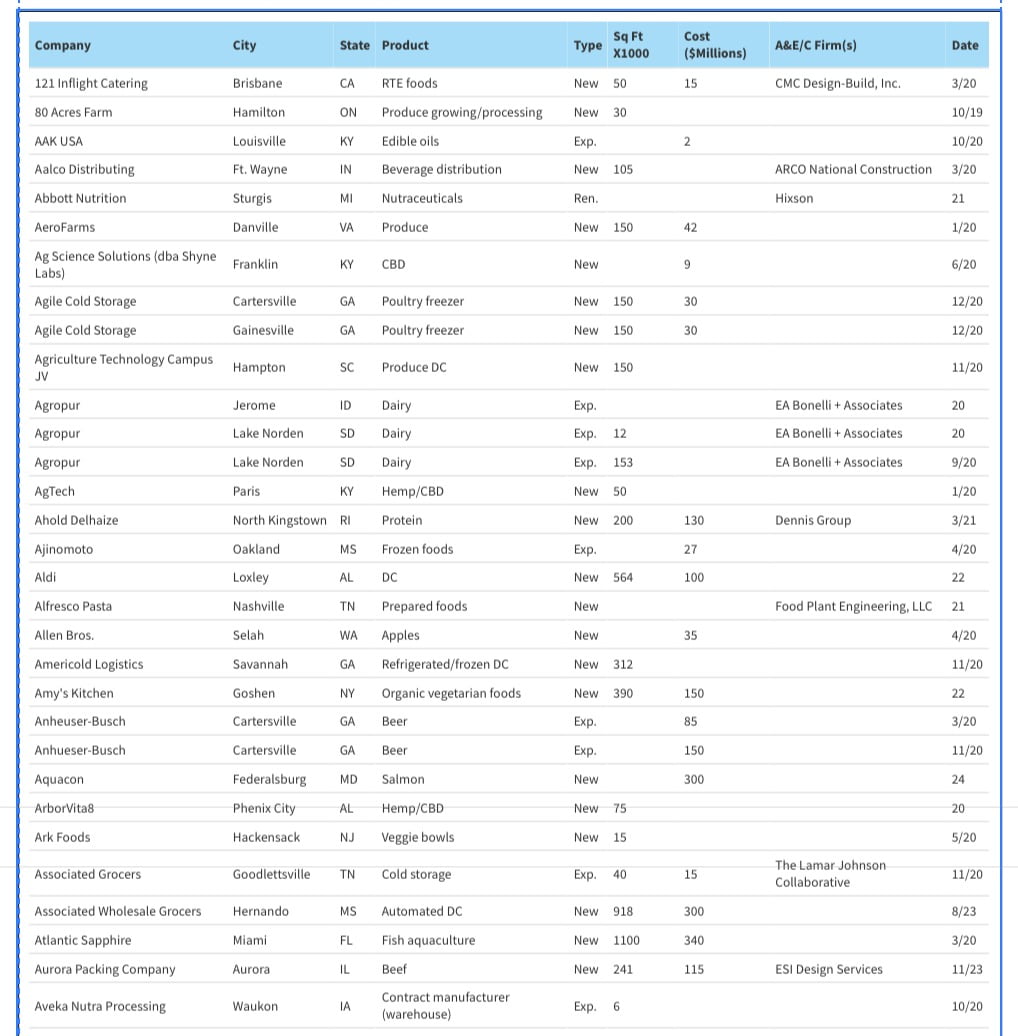

Reportable food and beverage-related projects are those valued at over $1 million. They have been made public by the processor, a government entity (including local or state economic development groups) or the A&E/C firms responsible for them. The survey (though the table lists “Completion Date” at the header) includes projects begun, announced by any entity or completed in 2020. If dates listed are beyond 2020, they reflect the projected completion date for a project either announced in 2020 or under way in 2020. Projects that appeared in last year’s table with a 2020 date were carried over—unless there was an obvious duplicate. Keep in mind, some projects can be announced, and then dropped at the last minute for any number of reasons, e.g., legal problems, lack of expected funding, site issues, changing needs, politics, etc. In the table, “D/W” refers to distribution/warehouse, and “DC” refers to distribution center; “Exp.” refers to expansion and “Ren.” is for renovations, and some projects include both.

For the last four years, the share of the pie for new projects compared to expansions and renovations has been increasing. (See “2017 through 2020 projects (percent of total.)”) Conversely, the ratio of expansions/renovations to new projects has been dropping and has reached 10-year low at 1.64. (See “Ratio of expansions/renovations to new projects 2011-2020.”)

Distribution centers on sharp rise

Working at home and ordering online has changed the way we procure our food, and there have been clear winners, as Alex DeMartini, vice president, industrial business unit at Clayco, points out. “Distribution and e-commerce are as busy as ever and these projects showed no sign of slowing during the pandemic. In fact, they accelerated as well.”

Our online food shopping habits have changed the scope of our industry. “Many of our clients are accelerating their adoption of e-commerce to adapt to the changing marketplace,” says Alex Garland, Burns & McDonnell project manager. “For instance, packaging format has evolved to support individual versus bulk shipments and distribution or automated storage and retrieval system inclusion with capacity increases and facility expansions.”

Previously processors were reluctant to have extra capacity in warehouses or production lines, however, what processors have learned about supply chain disruptions will change and drive extra capacity in the supply chain, says Keith Perkey, VP—Food & Beverage Division at The Haskell Company.

This extra capacity has really demonstrated itself in terms of warehouse and fulfillment/distribution center projects. The number of DC/warehouse projects for 2020 was 140, the highest number recorded since 2007. This represents a 40% increase from 2019 when 100 projects were listed. Of this year’s 140 projects, I counted 76 (more than half) to be new projects.

Pet food, CBD, alcohol and plant-based projects

Some A&E/C professionals also contend that COVID-19 was responsible for an increase of pet food manufacturing projects, which numbered 28, five more than the previous year of 23. But these numbers don’t tell the whole story. Mike Vetter, PE, senior project manager at SSOE, says pet owners will spend $99 billion on their pets this year. “We have seen a huge growth in our pet food business as people turned to and/or added pets to their families during the pandemic.”

Hemp/CBD projects, which are hard to number and track, counted for 24 projects in 2020, an increase of 11 projects recorded compared to the previous year. While a little easier to track, alcoholic beverage projects have increased, but these projects range from the macro/micro distillery and brewery level up to the gigantic projects at 500,000 or more square feet. Our survey counted 50 projects, up 22% from the prior year’s number of 41 projects. (See “Distribution center/warehouse and alcoholic beverage projects 2011-2020” for more details.)

Also included in the count is the category of plant-based meats or seafood and vegan products projects, which numbered 20. This category also includes vegetable proteins that wind up as an ingredient for plant-based meats and cell-based lines producing meat or seafood sans animal.

The big issues: Change for A&E/Cs and food processors

It’s been said—and attributed to Heraclitus, a Greek philosopher—that “change is the only constant in life.” Faithful+Gould has noticed its clients are focused on changing consumer demands and are redefining their production lines in response to those changes. Speed to market for food and beverage products is a high priority, says Gregory Franzen, LEED AP, director of AgriFood, Faithful+Gould.

With so many working at home because of COVID-19, the construction industry in general has seen big changes, too. For example, according to Brian King, founder and president of A M King, commercial (offices and retail projects) and institutional markets are significantly down and are expected to remain so over the next few months. Manufacturing—and especially food and beverage—are extremely active and will remain highly active for months to come.

Labor and materials

While food companies have invested in new projects, labor may get harder to find due to infrastructure markets opening up and creating new competitive jobs. “We further expect the Biden administration to significantly increase spending on infrastructure given its bipartisan support,” says King. “While it will take 18-24 months for the construction industry to realize the mobilization of these projects, once they begin, there will be a tightening on the construction labor markets, which will affect all construction sectors.”

Since 2017, the number of new projects has become an ever increasing piece of the total number of projects. In 2020, the proportion of new projects to renovations (Ren.) and expansions (Exp.) was the largest recorded for at least 10 years. Source: Food Engineering

But the availability of skilled specialty labor is not a new problem, and COVID-19 didn’t help. Ronald Rens, P.E., president of Gleeson Contractors & Engineers, says, “It is challenging to hire skilled artisans due to people receiving unemployment during the pandemic and the lack of young people entering the trade.”

“Over the past few years, confidence derived from the strong economy has benefited our industry by driving a surge of capital investment in plant improvements and expansions,” says Heath Catt, Burns & McDonnell construction leader. “This spending increase heightened the demand for craft labor at a time when labor availability was at an all-time low, followed by additional challenges that the COVID-19 pandemic introduced to the workplace. Demand for construction materials industry-wide also has risen while the pandemic, in parallel, has negatively impacted the supply chain.”

Mark Redmond, Food Plant Engineering president, warns processors about project delays. While the construction industry has been brisk, it does take prior planning to line things up for any given project. “The current supply chain does not allow for immediacy.”

“Lead times for construction materials, particularly structural steel and steel-related products, have increased significantly over the past six months and are continually increasing,” says Nate Larose, CMC Design-Build director of project development. This can result in a much longer project cycle and significantly increase the risk of escalating costs if not managed properly.

Steel prices have a significant impact on food processors since it’s used in everything from the building shell, to the equipment, to the piping and instruments used throughout a facility, says Mary Frances Stotler, Dennis Group senior partner. “We’re seeing food manufacturers hedge against rising prices in a variety of ways. Some are pre-purchasing steel for planned projects, while others are building additional contingency into capital budgets. In some instances, selecting alternative materials or finishes is also a viable option.”

But high costs and excessive lead times go beyond steel. According to Chris Allen, R.A., Hixson manager, construction administration, costs and lead times for shell materials are very volatile right now. For example, lead times for steel joist and deck have increased to 4-5 months instead of 8-10 weeks. In addition, the cost of mill steel, softwood lumber and aluminum are also spiking as demand exceeds expectations.

Amidst these challenges, COVID-19 has caused a rethink of interior design. Increased workflow space and ventilation, employee welfare areas, multiple shift alignments, and new security practices have to be implemented, says Tim Nguyen, senior VP at ESI Group USA. “Food plants have always placed high scrutiny on food and product safety integrity. That same emphasis must now be applied to employee and worker safety interaction with each other and the food product itself. These new trends will affect food facility sizes, layouts, space programming, and security infrastructure.”