State of Food Manufacturing part 1

2025

of food manufacturing

THE STATE

While sales were largely down under dynamic economic and geopolitical conditions, some of the world’s top food and beverage manufacturers experienced revenue growth.

Overall, food manufacturers continue to invest in equipment and training despite rising material and labor costs.

That’s according to FOOD ENGINEERING’s 46th State of Food Manufacturing survey, conducted annually in partnership with research firm myCLEARopinion Insights Hub. We asked food and beverage manufacturing professionals about operational improvements, equipment budgets, food safety implementation and more.

These insights, following our 48th Plant Construction Survey and our annual ranking of the Top 100 Food and Beverage Companies, offer a complete picture of manufacturers’ priorities, concerns and experiences.

By Alyse Thompson-Richards

A joint venture by Migros, Givaudan and Bühler Group, The Cultured Hub aims to help startups and other companies in the cultured meat space reduce infrastructure costs. Image courtesy of The Cultured Hub

Photo credit: Valerii Apetroaiei / Getty Images

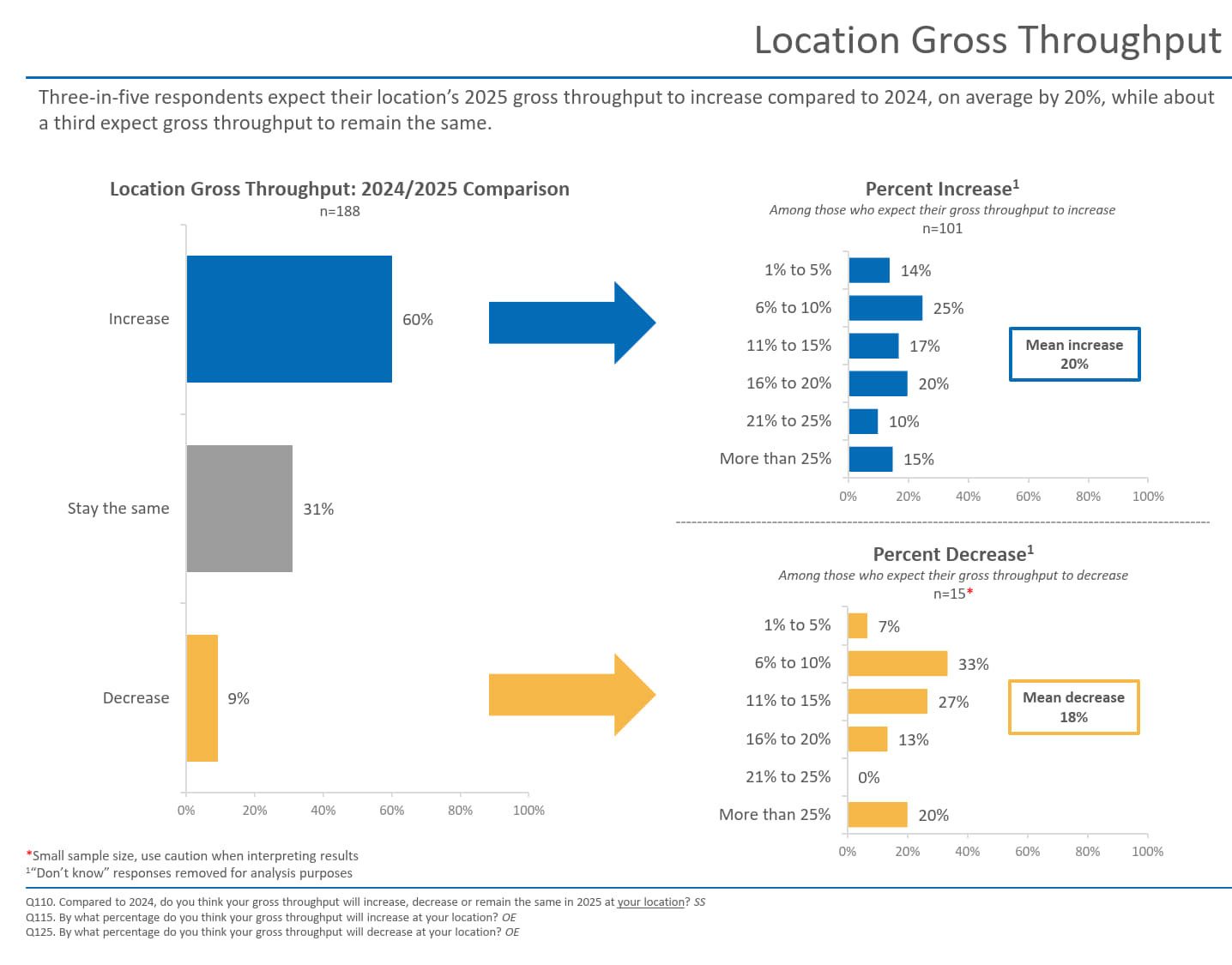

Throughput Expectations

Similar to 2024, three in five (60%) food manufacturing professionals expect their location’s throughput to increase in 2025 — by 20% on average. One quarter of respondents project their location’s throughput will increase by 6% to 10%, while 17% expect an increase of 11% to 15%. Another quarter expect a throughput increase of more than 20%.

Manufacturers cite increased business or new customers (28%) and increased demand (23%) as reasons driving growth in throughput, but expanded product offerings, expanded operations and improved efficiency also made the list.

Graphic courtesy of myCLEARopinion